INSURANCE INDUSTRY

Another key aspect of digital disruption in the insurance industry is the rise of insurtech companies. These companies use digital technologies to create new and innovative insurance products, often at a lower cost than traditional insurers. This is making the insurance industry more competitive and giving consumers more options.

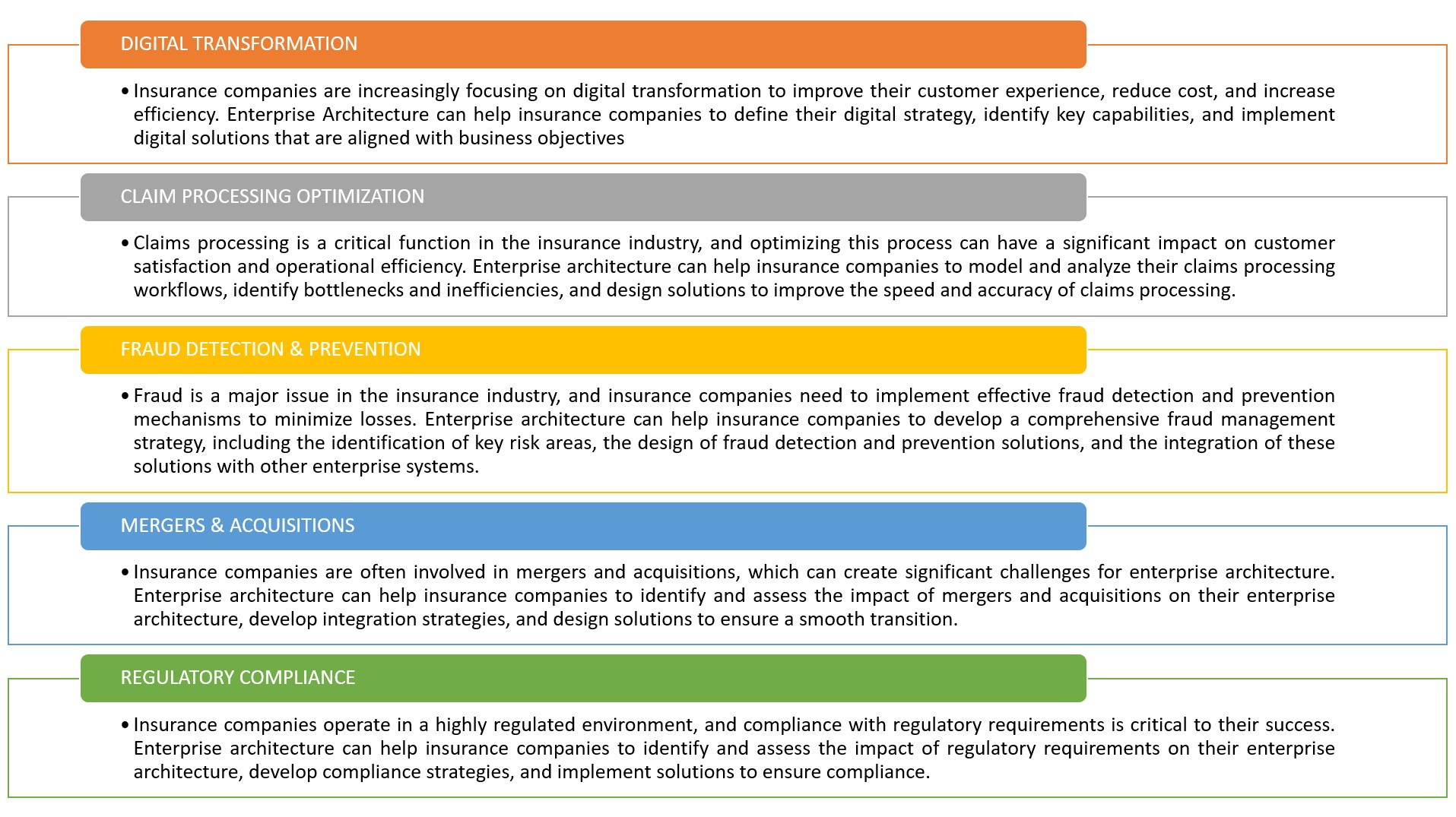

The insurance industry faces a number of business challenges, including increased competition, regulatory changes, and the need to embrace new technologies. One major challenge is the increasing competition from new entrants, such as insurtech companies, which are using technology to offer more efficient and personalized services to customers. This is putting pressure on traditional insurance companies to adapt and innovate in order to stay competitive.

Another challenge facing the industry is the changing regulatory environment. Governments around the world are introducing new laws and regulations aimed at protecting consumers and ensuring that insurance companies are financially stable. This can make it more difficult and costly for companies to operate, and can also make it harder for them to innovate and grow.

Finally, the industry is also facing pressure to embrace new technologies, such as big data and artificial intelligence. These technologies can help insurance companies to better understand and predict risks, and to offer more personalized and efficient services to customers. However, they also require significant investments in new systems and infrastructure, which can be a significant challenge for many companies.

In summary, the insurance industry is facing increased competition, regulatory changes, and the need to embrace new technologies, which all pose major business challenges for the industry. To stay competitive, insurance companies must adapt and innovate, and make investments in new systems and infrastructure.